We thought if we could get these interests in a room together, we could build a powerful consensus on our theory of change, and on what we need to win. We were right.

Kristen CrowellExecutive DirectorFair Share America

Finding a Shared North Star

Among convening participants from a nationwide organization was Mary Kusler, Senior Director for the National Education Association’s Center for Advocacy and co-chair of Fair Share America’s leadership committee.

One in every 100 Americans is an NEA member, she noted. On taxes, “we had been pretty bifurcated, with one infrastructure at the federal level and one at the state level, and not much communication in between. On top of that, planning for the mid- to long-range has not been our specialty. Convenings take a lot of resources, both of money and time.”

“The gift that The Rockefeller Foundation gave us by creating a space to convene on important issues was huge,” she said. “The week we spent there was hard work, and the days were long. But it gave us the chance to talk in detail, build trust, and find our shared North Star.

“We walked out with commitment and momentum. And that’s why we will be successful this time. The convening support from The Rockefeller Foundation was key because it lent clarity and urgency to the moment.”

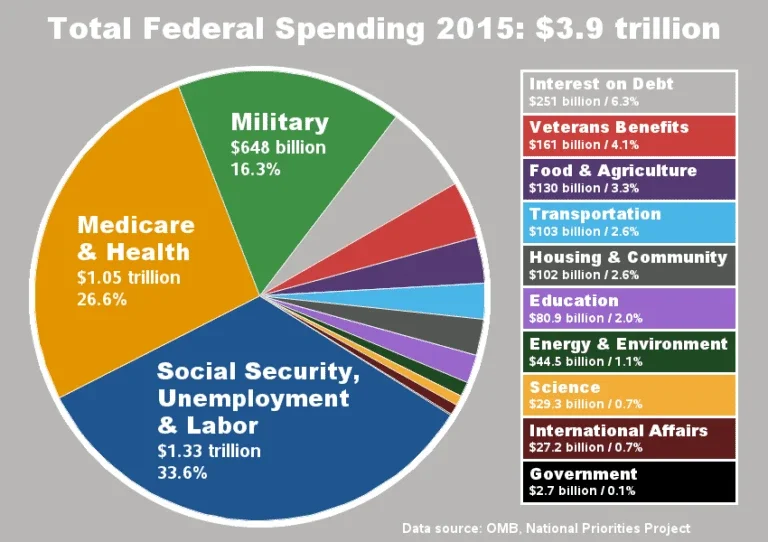

As climate-related disasters become more common, these federal costs are among those expected to rise dramatically, alongside higher bills for health care and insurance programs that become more vulnerable with shifting climate patterns.

Learn More About a Powerful Tax Credit

The Earned Income Tax Credit, established almost 50 years ago, is a powerful tool for working families. What exactly is it, and how does it work?

More in this Matter of Impact Edition

Food Security Leader Calls for Women's Voices in Convenings

For the last five decades, CGIAR has been one of the world’s most successful research and development organizations contributing to food, nutrition, sustainability, and poverty reduction.

read moreA Clean Energy Convening Changes a Life

After an inspiring convening hosted by The Rockefeller Foundation, Cassie Rowlands quit her job the following week, driven to make bigger changes and work more closely with communities to fund the green energy transition.

read more