During the Second World War, American and British economic policymakers began planning for a postwar order that could avoid future global wars.

In July 1944, as fighting still raged in Normandy following the D-Day landings, U.S. and British officials welcomed representatives from 42 other countries to Bretton Woods, New Hampshire, to create a multilateral system meant to restart growth, reopen trade, and react to crises after the devastation of World War II.

The Bretton Woods agreement created the global financial institutions designed to industrialize and interconnect economies to avoid the divergence that had proved so costly before the Second World War.

To a significant degree, this construct worked. Wealthier countries pledged to support financial institutions to lift up the most vulnerable and build a more stable world for everyone. Poorer countries used that support to invest in development initiatives that promote inclusive growth and bolster their people.

The result was not just a recovery from World War II’s devastation in Europe and Asia, but also significant economic growth over many decades.

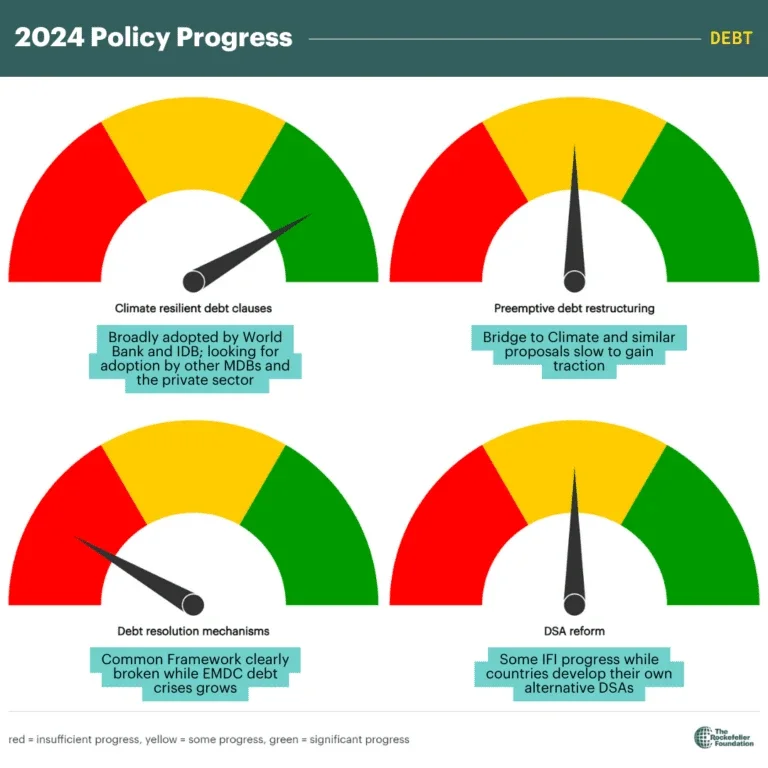

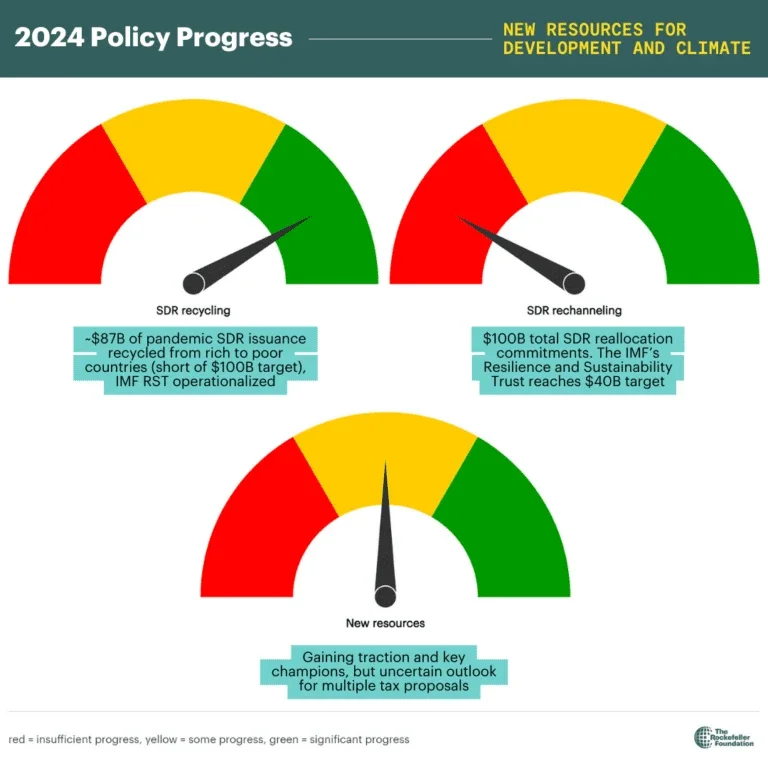

Yet the institutions which have done so much good in the past – and still represent hope to so many – are no longer able to meet their missions. In the last five years, several challenges – poverty exacerbated by the pandemic, spillover effects of the Ukraine war, and climate change – has rapidly outpaced their ability to respond. Many developing countries are drowning in debt – with interest payments quadrupling over the last decade for the poorest countries, topping education spending in 19 countries, and exceeding health expenditures in 45 countries.

As a result, confidence in this 80-year-old pact between wealthier countries and the poorer ones has greatly eroded.

The Rockefeller Foundation has played a vital role in developing and building broad support for reforming the Bretton Woods system.

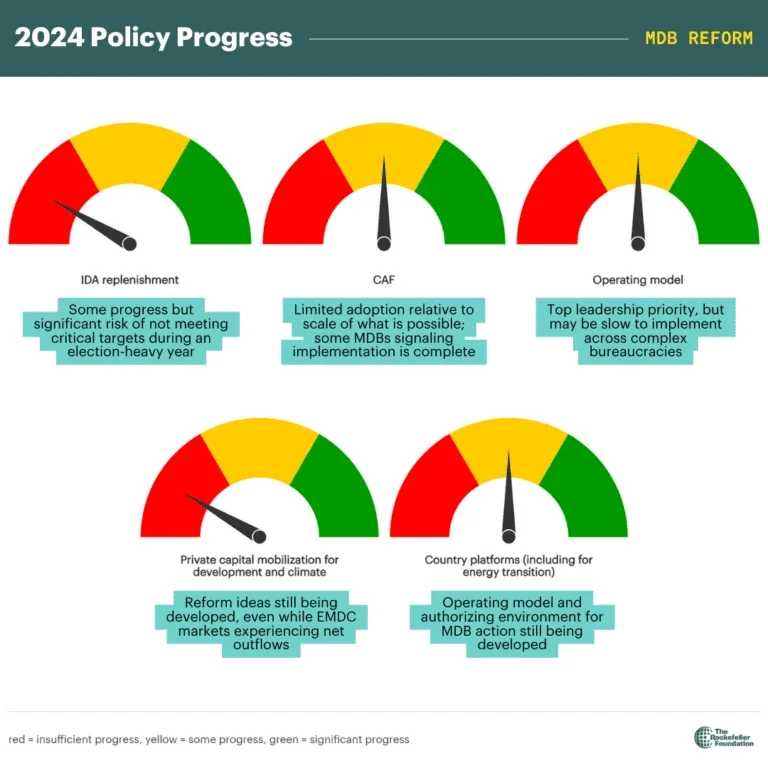

However, with needs so great, it is clear we need to go further, faster. We must meet these challenges with urgency and ambition, as our dashboard (released today) reaffirms.

Cognizant of this, the 2024 G20 President (and the COP30 President), Brazil, has stepped up with a detailed agenda to reform the Bretton Woods system to produce more and higher quality capital for emerging markets and developing countries. Not decades in the future, but now.

Alongside many others, The Rockefeller Foundation has partnered with the Brazilian government to advance this agenda, whether through CAF implementation, debt-for-health-swaps, a holistic MDB operational review, and improved debt sustainability.