Spotlight Stories

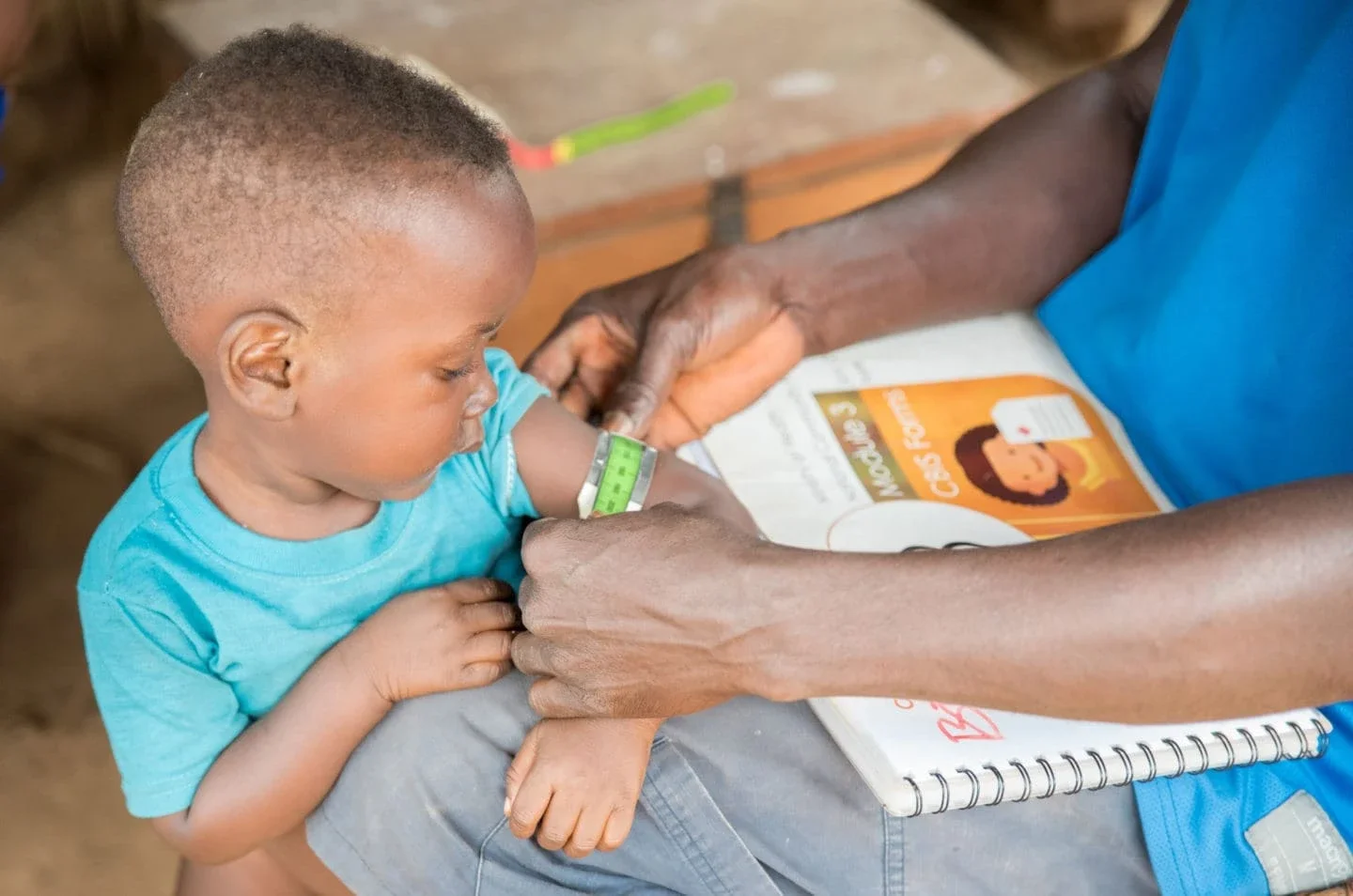

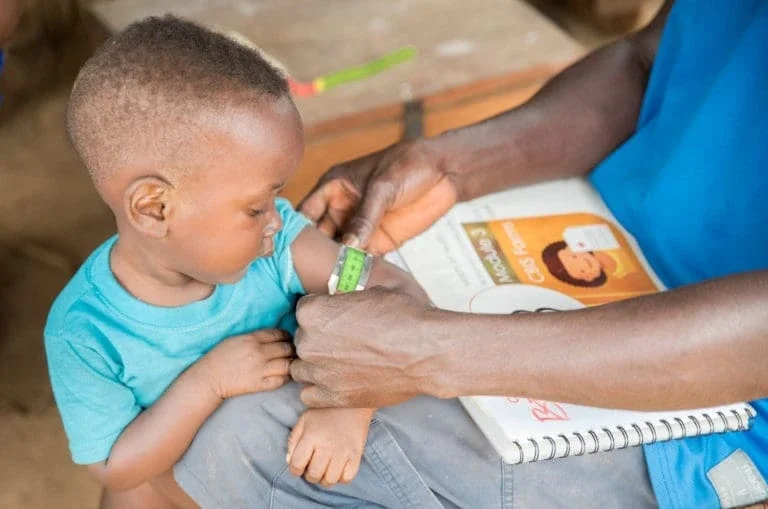

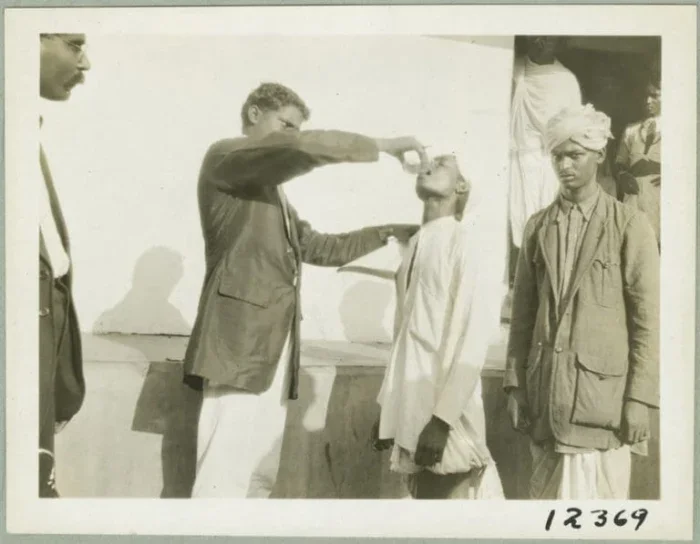

112 Years of Driving Change

From our initial grant to the American Red Cross a century ago, The Rockefeller Foundation’s history is marked by bold initiatives, breakthroughs, and unique partnerships, driving transformative change toward a more equitable and resilient world.

Big Bets: How Large-Scale Change Really Happens

A new playbook by Dr. Rajiv J. Shah with stories that show you it is realistic to be optimistic about our capacity to make large-scale change.

Order Today

Recent News

- Feb 13 2026Statement by Elizabeth Yee, Executive Vice President of The Rockefeller Foundation, on Science and Data

- Feb 03 2026The Cost of International Development Aid Cuts: 22.6 Million Deaths Expected by 2030, Study Finds

- Feb 02 2026Statement by Dr. Rajiv J. Shah on the Human Cost of Foreign Aid Cuts